SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

SCHEDULE 14A INFORMATION | ||||||

| Proxy Statement Pursuant to Section 14(a) of the | ||||||

| Securities Exchange Act of 1934 | ||||||

| (Amendment No. ) | ||||||

Filed by the Registrant x | Filed by a Party other than the Registrant ¨ | |||||

| Check the appropriate box: | ||||||

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to § 240.14a-11(c) or § 240.14a-12 | |

Payment of Filing Fee (Check the appropriate box):

| Payment of Filing Fee (Check the appropriate box): | ||||

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-1 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

Persons who are to respond to the collection

3355 Las Vegas Boulevard South, Las Vegas, Nevada 89109.

21, 2017.

Yours sincerely,

SHELDON G. ADELSON

| Yours sincerely, | |

| |

SHELDON G. ADELSON Chairman of the Board and Chief Executive Officer | |

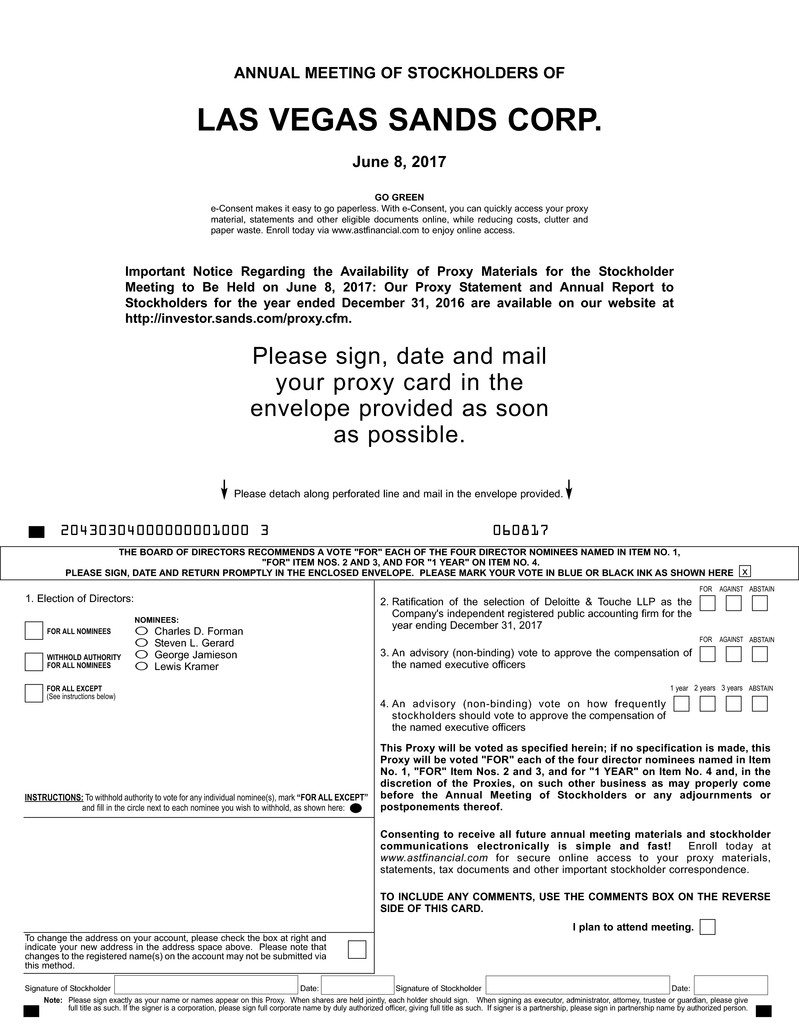

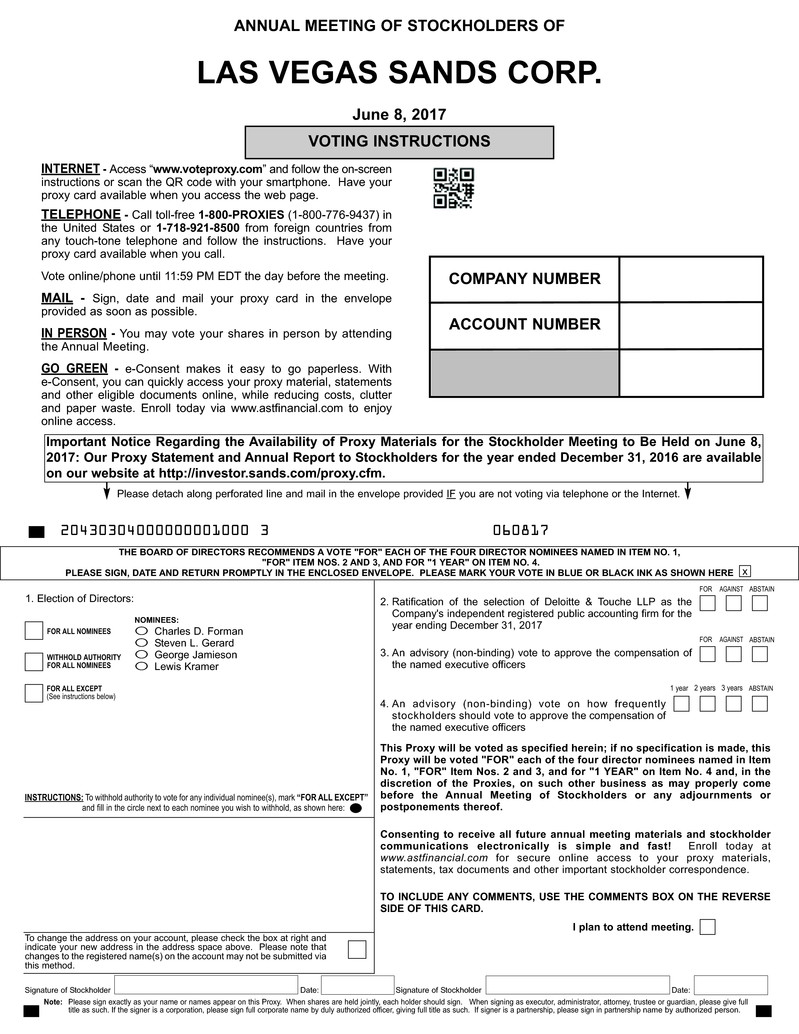

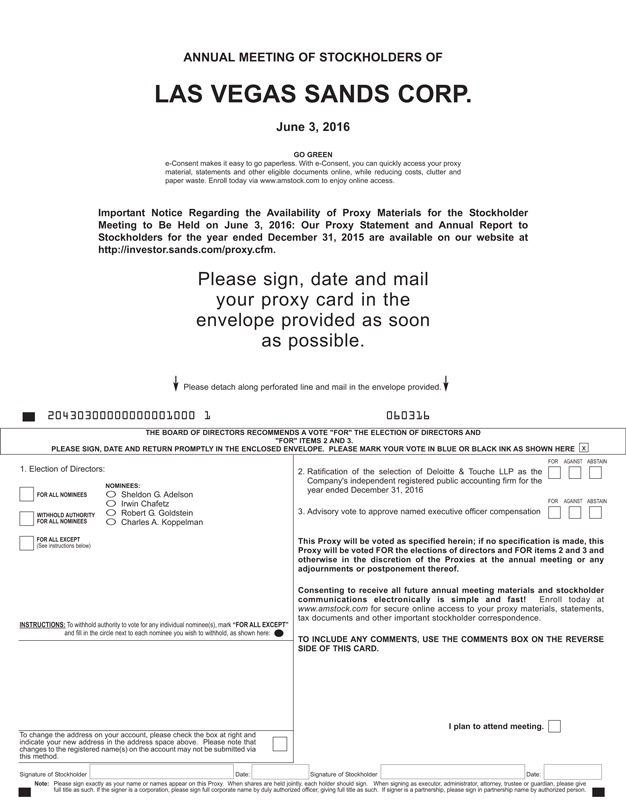

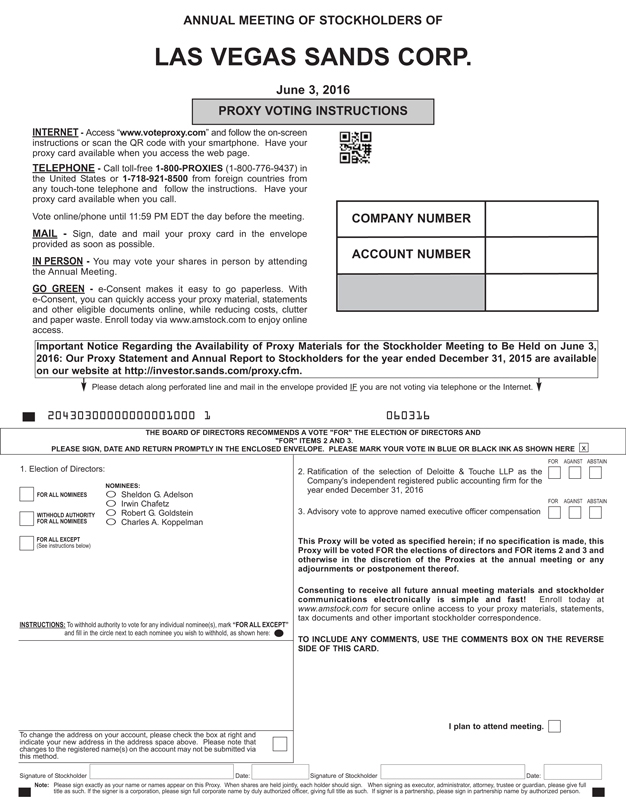

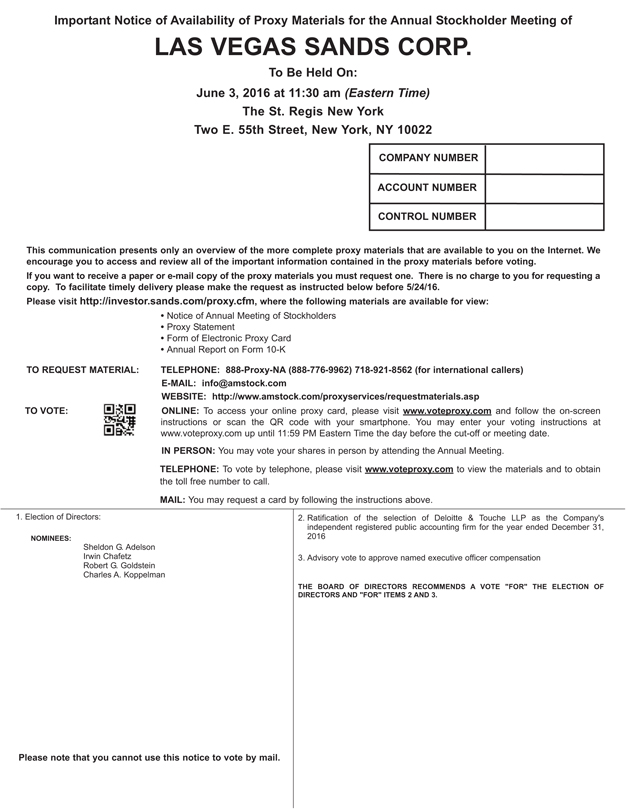

1. to elect four directors to the Board of Directors, each for a three-year term;

2. to consider and act upon the ratification of the selection of our independent registered public accounting firm;

3. to consider and act upon an advisory (non-binding) proposal on the compensation of the named executive officers; and

4. to transact such other business as may properly come before the meeting or any adjournments thereof.

| 1. | to elect four directors to the Board of Directors to serve until the 2020 meeting; |

| 2. | to ratify the selection of our independent registered public accounting firm; |

| 3. | to vote on an advisory (non-binding) proposal to approve the compensation of the named executive officers; |

| 4. | to vote on an advisory (non-binding) proposal on how frequently stockholders should vote to approve the compensation of the named executive officers; and |

| 5. | to transact such other business as may properly come before the meeting or any adjournments or postponements thereof. |

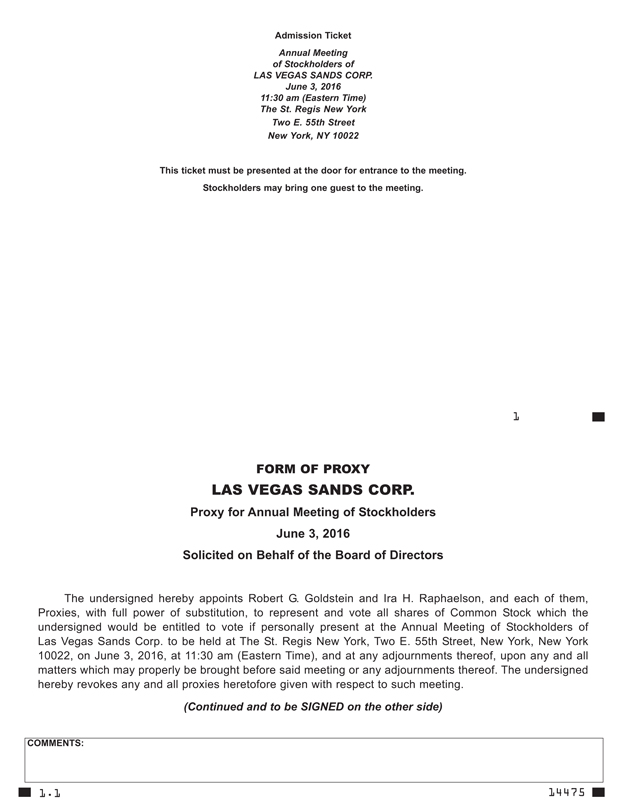

By Order of the Board of Directors,

IRA H. RAPHAELSON

Executive Vice President, Global General Counsel

and Secretary

April 22, 2016

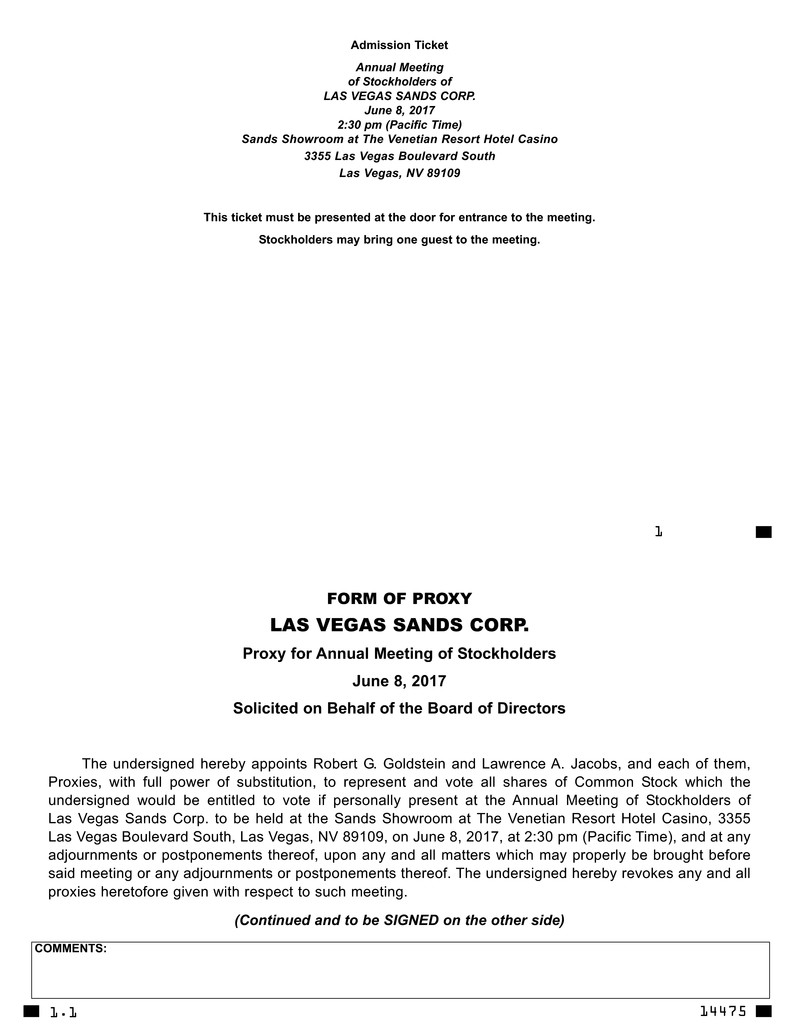

| By Order of the Board of Directors, | |

| |

Lawrence A. Jacobs Executive Vice President, Global General Counsel and Secretary | |

| Page | ||||

21, 2017.

If you duly submit a proxy but do not specifybelow or the advisory proposal on how you wantfrequently stockholders should vote to vote, your shares will be votedapprove compensation of our named executive officers as our Board recommends, which is:

| |||||

| If you duly submit a proxy but do not specify how you want to vote, your shares will be voted as our Board recommends, which is: | |||||

| • “FOR” the election of each of the nominees for director as set forth under Proposal No. 1 below; | |||||

| • |

| |||||||

| • |

| ||||||

| • For the selection of "ONE YEAR" as the frequency to vote on the advisory proposal on executive compensation as described in Proposal No. 4 below. | |||||||

by notifying the Corporate Secretary of the revocation or change in writing; by delivering to the Corporate Secretary a later dated proxy; or by voting in person at the annual meeting. each person known to us to be the beneficial owner, in an individual capacity or as a member of a each named executive officer; each of our directors; and all of our executive officers and directors, taken together. Name of Beneficial Owner(2) Sheldon G. Adelson(3)(4) Dr. Miriam Adelson(3)(5) Timothy D. Stein(3)(6) General Trust under the Sheldon G. Adelson 2007 Remainder Trust(3)(7) General Trust under the Sheldon G. Adelson 2007 Friends and Family Trust(3)(8) Robert G. Goldstein(9) Ira H. Raphaelson(10) Patrick Dumont(11) George M. Markantonis(12) George Tanasijevich(13) Jason N. Ader(14) Irwin Chafetz(3)(15) Micheline Chau(16) Charles D. Forman(17) Steven L. Gerard(18) George Jamieson(19) Charles A. Koppelman(20) David F. Levi(21) All current executive officers and current directors of our Company, taken together (14 persons)(22) A person is deemed to be a “beneficial owner” of a security if that person has or shares voting power, which includes the power to vote or direct the voting of such security, or investment power, which includes the power to dispose of or to direct the disposition of such security. A person is also deemed to be a beneficial owner of any securities of which that person has a right to acquire beneficial ownership within 60 days. Securities that can be so acquired are deemed to be outstanding for purposes of computing such person’s ownership percentage, but not for purposes of computing any other person’s percentage. Under these rules, more than one person may be deemed a beneficial owner of the same securities and a person may be deemed to be a beneficial owner of such securities as to which such person has no economic interest. Except as otherwise indicated in these footnotes, each of the beneficial owners has, to our knowledge, the sole voting and investment power with respect to the indicated shares of Common Stock. Percentages are based on How to Revoke or Change Your VoteYou may revoke or change your proxy at any time before it is exercised in any of three ways:You will not revoke a proxy merely by attending the annual meeting. To revoke or change a proxy, you must take one of the actions described above.If you hold your shares in a brokerage or other account, you may submit new voting instructions by contacting your broker, bank or nominee.Any revocation of a proxy, or a new proxy bearing a later date, should be sent to the following address: Corporate Secretary, Las Vegas Sands Corp., 3355 Las Vegas Sands Boulevard South, Las Vegas, Nevada 89109. To revoke a proxy previously submitted by telephone, Internet or mail, simply submit a new proxy at a later date before the taking of the vote at the annual meeting, in which case, the later submitted proxy will be recorded and the earlier proxy will be revoked.If you hold your shares in a brokerage or other account, you may submit new voting instructions by contacting your broker, bank or nominee.2Other Matters to be Acted upon at the MeetingOur Board presently is not aware of any matters other than those specifically stated in the Notice of Annual Meeting that are to be presented for action at the annual meeting. If any matter other than those described in this Proxy Statement is presented at the annual meeting on which a vote may properly be taken, the shares represented by proxies will be voted in accordance with the judgment of the person or persons voting those shares.Adjournments and PostponementsAny action on the items of business described above may be considered at the annual meeting at the time and on the date specified above or at any time and date to which the annual meeting may be properly adjourned or postponed.Electronic Delivery of Proxy Materials and Annual ReportThe Notice of Annual Meeting and Proxy Statement and the Company’s 2015 Annual Report are available athttp://investor.sands.com/proxy.cfm. These materials are also available on the Investor Relations page of our website,http://investor.sands.com. In the future, for stockholders who have not already opted to do so, instead of receiving copies of the Notice of Annual Meeting and Proxy Statement and annual report in the mail, stockholders may elect to view proxy materials for the annual meeting on the Internet or receive proxy materials for the annual meeting by e-mail. The Notice will provide you with instructions regarding how to view our proxy materials for the annual meeting on the Internet and how to instruct us to send future proxy materials to you electronically by e-mail. Receiving your proxy materials online saves the Company the cost of producing and mailing documents to your home or business and gives you an automatic link to the proxy voting site.Stockholders of Record. If your shares are registered in your own name, to enroll in the electronic delivery service go directly to the website of our transfer agent, American Stock Transfer & Trust Company, https://www.amstock.comat any time and follow the instructions.Beneficial Stockholders. If your shares are not registered in your name, check the information provided to you by your bank or broker to enroll in the electronic delivery service, or contact your bank or broker for information on electronic delivery service.Delivery of One Notice or Proxy Statement and Annual Report to a Single Household to Reduce Duplicate MailingsIn connection with the Company’s annual meeting of stockholders, the Company is required to send to each stockholder of record a Notice or a Proxy Statement and annual report, and to arrange for a Notice or a Proxy Statement and annual report to be sent to each beneficial stockholder whose shares are held by or in the name of a broker, bank, trust or other nominee. Because many stockholders hold shares of Common Stock in multiple accounts, this process would result in duplicate mailings of Notices or Proxy Statements and annual reports to stockholders who share the same address. To avoid this duplication, unless the Company receives instructions to the contrary from one or more of the stockholders sharing a mailing address, only one Notice or Proxy Statement and annual report will be sent to each address. Stockholders may, on their own initiative, avoid receiving duplicate mailings and save the Company the cost of producing and mailing duplicate documents as follows:Stockholders of Record.If your shares are registered in your own name and you are interested in consenting to the delivery of a single Notice or Proxy Statement and annual report, toyou may enroll in the electronic delivery service goby going directly to our transfer agent’s website at https://www.amstock.comwww.astfinancial.com anytime and follow the instructions.Beneficial Stockholders.If your shares are not registered in your own name, your broker, bank, trust, or other nominee that holds your shares may have asked you to consent to the delivery of a single Notice or Proxy Statement and annual report if there are other Las Vegas Sands Corp. stockholders who share an address with you. If you currently receive more than one Notice or Proxy Statement and annual report at your household, and would like to receive only one copy of each in the future, you should contact your nominee.Right to Request Separate Copies.If you consent to the delivery of a single Notice or Proxy Statement and annual report, but later decide that you would prefer to receive a separate copy of the Notice or Proxy Statement and annual report, as applicable, for each stockholder sharing your address, then please notify us or your nominee, as applicable, and we or they will promptly deliver such additional Notices or Proxy Statements and annual reports. If you wish to receive a separate copy of the Notice or Proxy Statement and annual report for each stockholder sharing your address in the future, you may contact our transfer agent, American Stock Transfer & Trust Company, directly by telephone at 1-800-937-5449 or by visiting its website athttps://www.amstock.comwww.astfinancial.com and following the instructions.Important Notice about SecurityAll meeting attendees may be asked to present a valid, government-issued photo identification (federal, state or local), such as a driver’s license or passport, and proof of beneficial ownership if you hold your shares through a broker, bank or other nominee before entering the meeting. Attendees may be subject to security inspections. Video and audio recording devices and other electronic devices will not be permitted at the meeting.3SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENTThe following table sets forth information as of April 12, 201610, 2017 as to the beneficial ownership of our Common Stock, in each case, by:“group,”"group," of more than 5% of our Common Stock; Beneficial Ownership(1) Shares Percent (%) 78,658,227 9.9 % 328,498,913 41.3 5,829,231 * 87,718,919 11.0 87,718,918 11.0 616,311 * 24,417 * 30,000 * 4,485 * 197,654 * 72,006 * 249,470,932 31.4 3,061 * 214,801 * 3,685 * 4,296 * 8,094 * 3,438 * 79,921,897 10.1 % Beneficial Ownership(1) Name of Beneficial Owner(2) Shares Percent (%) Sheldon G. Adelson(3)(4)78,826,722 9.9 % Dr. Miriam Adelson(3)(5)327,085,377 41.3 General Trust under the Sheldon G. Adelson 2007 Remainder Trust(3)(6)87,718,919 11.1 General Trust under the Sheldon G. Adelson 2007 Friends and Family Trust(3)(7)87,718,918 11.1 Robert G. Goldstein(8)766,212 * Patrick Dumont(9)107,500 * Lawrence A. Jacobs — * George Tanasijevich(10)197,654 * Ira H. Raphaelson(11)24,417 * Irwin Chafetz(3)(12)252,632,902 31.9 Micheline Chau(13)6,443 * Charles D. Forman(14)216,940 * Steven L. Gerard(15)6,692 * George Jamieson(16)6,435 * Charles A. Koppelman(17)10,819 * Lewis Kramer — * David F. Levi(18)7,197 * All current executive officers and current directors of our Company, taken together (12 persons)(19)80,038,521 10.1 % ____________________* Less than 1%.*Less than 1%.(1)794,718,776792,268,004 shares issued and outstanding at the close of business on April 12, 201610, 2017 (including unvested shares of restricted stock, but excluding treasury shares), plus any shares of our Common Stock underlying options held by all individuals listed on the table that are vested and exercisable.

(2) | Other than |

(3) | Sheldon G. Adelson, Dr. Miriam Adelson, |

(4) | This amount includes (a) |

(5) | This amount includes (a) 93,779,145 shares of our Common Stock held by Dr. Adelson, (b) 1,912,515 shares of our Common Stock held by trusts for the benefit of Dr. Adelson and her family members over which Dr. Adelson, as trustee, retains sole voting control and shares dispositive power, (c) |

(6) |

|

This amount includes 87,718,919 shares of our Common Stock held by the General Trust under the Sheldon G. Adelson 2007 Remainder Trust. |

This amount includes 87,718,918 shares of our Common Stock held by the General Trust under the Sheldon G. Adelson 2007 Friends and Family Trust. |

This amount includes (a) |

This amount includes |

|

|

This amount includes (a) 25,179 shares of our Common Stock held by Mr. Tanasijevich, and (b) options to purchase 172,475 shares of our Common Stock that are vested and exercisable. |

Mr. Raphaelson ceased to serve as Executive Vice President and Global General Counsel on August 21, 2016. |

(12) | This amount includes (a) |

|

This amount includes (a) 1,818 shares of our Common Stock held by Ms. Chau, (b) 2,139 unvested shares of restricted stock |

This amount includes (a) |

This amount includes (a) |

This amount consists of (a) |

This amount includes (a) |

(18) | This amount includes (a) 1,818 shares of our Common Stock held by Mr. Levi, (b) 2,139 unvested shares of restricted stock and |

This amount includes |

|

Board may designate. Name (Age), Principal Occupation and Other Directorships Charles D. Forman (70) Mr. Adelson has been Chairman of the Board, Chief Executive Officer, Treasurer and a Name (Age), Principal Occupation and Other Directorships Irwin Chafetz Mr. Chafetz has been a Ms. Chau has been a Mr. Name (Age), Principal Occupation and Other Directorships Mr. David F. Levi Mr. Levi has been a NYSE Listing Standards.As required by the NYSE’s corporate governance rules, the Company’s Board currently has a majority of independent directors. In addition, all of the members of the Company’s Audit Committee, Compensation Committee, Nominating and Governance Committee and Compliance Committee (as further described below) are independent directors. individuals who served as a member of our Compensation Committee during our Audit Committee Charter; our Compensation Committee Charter; our Nominating and Governance Committee Charter; our Compliance Committee Charter; our Corporate Governance Guidelines; our Code of Business Conduct and Ethics; our Anti-Corruption Policy; and our Statement on Reporting Ethical Violations. the details of any such proposed transactions. Under guidelines established by our Audit Committee, proposed transactions and matters requiring approval under our policies with aggregate values of less than $120,000 per year are presented to the Audit Committee quarterly for review. Larger transactions are presented to our Audit Committee for review, discussion and the ethical standards and integrity of the candidate in personal and professional dealings; the independence of the candidate under legal, regulatory and other applicable standards; the diversity of the existing Board, so that a body of directors from diverse professional and personal backgrounds is maintained; whether the skills and experience of the candidate will complement that of the existing members of the Board; the number of other public company boards of directors on which the candidate serves or intends to serve, with the expectation that the candidate would not serve on the boards of directors of more than three other public companies; the ability and willingness of the candidate to dedicate sufficient time, energy and attention to ensure the diligent performance of his or her Board duties; the ability of the candidate to read and understand fundamental financial statements and understand the use of financial ratios and information in evaluating the financial performance of the Company; the willingness of the candidate to be accountable for his or her decisions as a director; the ability of the candidate to provide wise and thoughtful counsel on a broad range of issues; the ability and willingness of the candidate to interact with other directors in a manner that encourages responsible, open, challenging and inspired discussion; whether the candidate has a history of achievements that reflects high standards; the ability and willingness of the candidate to be committed to, and enthusiastic about, his or her performance for the Company as a director, both in absolute terms and relative to his or her peers; whether the candidate possesses the courage to express views openly, even in the face of opposition; the ability and willingness of the candidate to comply with the duties and responsibilities set forth in the Company’s Corporate Governance Guidelines and by-laws; the ability and willingness of the candidate to comply with the duties of care, loyalty and confidentiality applicable to directors of publicly traded corporations organized in the Company’s jurisdiction of incorporation; the ability and willingness of the candidate to adhere to the Company’s Code of Business Conduct and Ethics, including the policies on conflicts of interest expressed therein; and such other attributes of the candidate and external factors as the Board deems appropriate. Stockholders and interested parties who wish to contact our Board, the Chairman of the Board, the presiding non-management director of executive sessions or any individual director are invited to do so by writing to: Complaints and concerns relating to our accounting, internal accounting controls, or auditing matters should be communicated to the Audit Committee of our Board, which consists solely of non-employee directors. Any such communication may be anonymous and may be reported to the Audit Committee through the Office of the General Counsel by writing to: Name Title Sheldon G. Adelson Chairman of the Board, Chief Executive Officer and Treasurer Robert G. Goldstein President and Chief Operating Officer Patrick Dumont Executive Vice President and Chief Financial Officer Executive Vice President and Global General Counsel and Secretary Sheldon G. Adelson, our Chairman, Chief Executive Officer and Treasurer; Robert G. Goldstein, our President and Chief Operating Officer; George consolidated net revenue of consolidated net income of $2.02 billion; and Consolidated adjusted property EBITDA is a non-GAAP financial measure. See "Item 8 - Financial Statements and Supplementary Data - Notes to Consolidated Financial Statements - Note 17 - Segment Information" of the Company's Annual Report on Form 10-K for the year ended December 31, 2016 for the definition of consolidated adjusted property EBITDA, and a reconciliation of consolidated adjusted property EBITDA to net The Objectives of Our Executive Compensation Program5BOARD OF DIRECTORSOur Board currently has teneleven directors, divided into three classes, designated as Class I, Class II and Class III. Members of each class serve for a three-year term. Stockholders elect one class of directors at each annual meeting. The term of office of the current Class IIII directors will expire at the 20162017 annual meeting. The term of office of the current Class III directors will be subject to renewalexpire in 2017,2018 and the term of office of the current Class IIIII directors will be subject to renewalexpire in 2018.2019. Each director holds office until his or her successor has been duly elected and qualified or the director’s earlier resignation, death or removal.We have nominated four individuals to serve as Class IIII directors: Sheldon G. Adelson, Irwin Chafetz, Robert G. GoldsteinCharles D. Forman, Steven L. Gerard, George Jamieson and Charles A. Koppelman.Lewis Kramer. Each of the nominees is a current director of the Company who has indicated that he will serve if elected. We do not anticipate that any of the nominees will be unable or unwilling to stand for election,serve, if elected, but if that happens, your proxy will be votedit is the intention of the persons named in the proxies to select and cast their votes for anotherthe election of such other person nominated byor persons as the Board.In addition to the specific professional experience of our directors, we chose our directors because they are highly accomplished in their respective fields, insightful and inquisitive. In addition, we believe each of our directors possesses sound business judgment and is highly ethical. While we do not have a formal diversity policy, we consider a wide range of factors in determining the composition of our Board, including professional experience, skills, education, training and background.The nominees for election for a three-year term ending in 20192020 and their backgrounds are as follows: FirstBecame aDirector Class 2004 I Mr. Forman has been a Director of the Company since August 2004. He has been a director of Las Vegas Sands, LLC (or its predecessor, Las Vegas Sands, Inc.) since March 2004. In addition, he has served as a member of the board of directors of the Company’s subsidiary, Sands China Ltd., since May 2014. Mr. Forman served as chairman and chief executive officer of Centric Events Group, LLC, a trade show and conference business from April 2002 until his retirement upon the sale of the business in 2007. From 2000 to 2002, he served as a director of a private company and participated in various private equity investments. During 2000, he was executive vice president of international operations of Key3Media, Inc. From 1998 to 2000, he was chief legal officer of ZD Events Inc., a tradeshow business that included COMDEX. From 1995 to 1998, Mr. Forman was executive vice president, chief financial and legal officer of Softbank Comdex Inc. From 1989 to 1995, Mr. Forman was vice president and general counsel of The Interface Group, a tradeshow and convention business that owned and operated COMDEX. Mr. Forman was in private law practice from 1972 to 1988. Mr. Forman is a member of the board of trustees of The Dana-Farber Cancer Institute and treasurer and a director of Nantucket Jewish Cemetery, Inc. Mr. Forman’s extensive experience in the hospitality, trade show and convention businesses led the Board to conclude that he would be a valuable member of our Board of Directors. Steven L. Gerard (71) 2014 I Mr. Gerard has been a Director of the Company since July 2014. He served as the chief executive officer of CBIZ, Inc., a provider of integrated business services and products, from October 2000 until his retirement in March 2016, and continues to serve as the chairman of its board of directors, a position he has held since October 2002. Mr. Gerard was chairman and chief executive officer of Great Point Capital, Inc., a provider of operational and advisory services from 1997 to October 2000. From 1991 to 1997, he was chairman and chief executive officer of Triangle Wire & Cable, Inc. and its successor, Ocean View Capital, Inc. Mr. Gerard’s prior experience includes 16 years with Citibank, N.A. in various senior corporate finance and banking positions. Further, Mr. Gerard served seven years with the American Stock Exchange, where he last served as vice president of the securities division. Mr. Gerard also serves on the board of directors of Lennar Corporation, a home builder, and had served on the board of directors of Joy Global, Inc., a manufacturer and servicer of mining equipment. Mr. Gerard’s extensive executive experience and service as a director of other public companies led the Board to conclude that he would be a valuable member of our Board of Directors. 6Name (Age), Principal Occupation and Other Directorships FirstBecame aDirectorClass George Jamieson (80) 2014 I Mr. Jamieson has been a Director of the Company since June 2014. He is a certified public accountant and a retired partner of PricewaterhouseCoopers LLP. He served in various positions at PricewaterhouseCoopers LLP (or predecessor firms) in various capacities from 1964 until 1997. Mr. Jamieson is a member of the American Institute of Certified Public Accountants. He recently retired as a member of the executive committee of the board of directors of the American Liver Foundation and has served on the boards of directors of many other charitable and civic organizations. Mr. Jamieson’s extensive experience in the accounting profession, including his experience auditing public companies and his international experience, as well as his service on the boards of directors of charitable and civic organizations led the Board to conclude that he would be a valuable member of our Board of Directors. Lewis Kramer (69) 2017 I Mr. Kramer has been a Director of the Company since April 2017. Mr. Kramer was a partner at Ernst & Young LLP from 1981 until he retired in June 2009 after a nearly 40-year career at Ernst & Young LLP. At the time of his retirement, Mr. Kramer served as the global client service partner for worldwide external audit and all other services for major clients, and served on the firm’s United States executive board. He previously served as Ernst & Young LLP's national director of audit services. Mr. Kramer has served on the board of directors of L3 Technologies, Inc., since 2009. Mr. Kramer’s extensive financial and business knowledge gained while serving as an independent auditor for organizations across diverse industries and his experience as a director of a public company and non-profit organizations led the Board to conclude that he would be a valuable member of our Board of Directors. The other members of the Board who will continue to serve following our 2017 annual meeting are as follows:Name (Age), Principal Occupation and Other Directorships FirstBecame aDirectorClass Sheldon G. Adelson (82)(83) 2004 III directorDirector of the Company since August 2004. He has been Chairmanchairman of the Board, Chief Executive Officerboard, chief executive officer and a director of Las Vegas Sands, LLC (or its predecessor, Las Vegas Sands, Inc.) since April 1988 when it was formed to own and operate the former Sands Hotel and Casino. Mr. Adelson has served as the Chairmanchairman of the Boardboard of Directorsdirectors of the Company’s subsidiary, Sands China Ltd., since August 2009 and as its chief executive officer since January 2015. Mr. Adelson also created and developed The Sands Expo and Convention Center, the first privately owned convention center in the United States, which was transferred to the Company in July 2004. In addition, Mr. Adelson serves as an officer and/or director of several of our other subsidiaries. His business career spans more than seven decades and has included creating and developing to maturity more than 50 different companies. Mr. Adelson has extensive experience in the convention, trade show, and tour and travel businesses. He created and developed the COMDEX Trade Shows, including the COMDEX/Fall Trade Show, which was the world’s largest computer show in the 1990s. He has been the Presidentpresident and Chairmanchairman of Interface Group Holding Company, Inc. and its predecessors since the mid-1970s and is a manager of Interface Group-Massachusetts, LLC and was Presidentpresident of its predecessors since 1990. Mr. Adelson has earned multiple honorary degrees and has been a guest lecturer at various colleges and universities, including the University of New Haven, Harvard Business School, Columbia Business School, Tel Aviv University and Babson College. Among his numerous awards for his business and philanthropic work are the Armed Forces Foundation’s Patriot Award, the Hotel Investment Conference’s Innovation Award and the Woodrow Wilson Award for Corporate Citizenship, and induction into the American Gaming Association’s Hall of Fame. Mr. Adelson’s extensive business experience, including his experience in the hospitality and meetings, incentives, convention and exposition businesses, and his role as our Chief Executive Officer and Treasurer, led the Board to conclude that he shouldwould be a valuable member of our Board of Directors. 7 FirstBecame aDirector Class (80)(81) 2005 III directorDirector of the Company since February 2005. He was a director of Las Vegas Sands, Inc. from February until July 2005. Mr. Chafetz is a Managermanager of The Interface Group, LLC, a Massachusetts limited liability company that controls Interface Group-Massachusetts, LLC. Mr. Chafetz has been associated with Interface Group-Massachusetts, LLC and its predecessors since 1972. From 1989 to 1995, Mr. Chafetz was a Vice Presidentvice president and director of Interface Group-Nevada, Inc., which owned and operated trade shows, including COMDEX, and also owned and operated The Sands Expo and Convention Center. From 1989 to 1995, Mr. Chafetz was also Vice Presidentvice president and a director of Las Vegas Sands, Inc. Mr. Chafetz has served on the boards of directors of many charitable and civic organizations and is a member of the Boardboard of Trusteestrustees at Suffolk University and a former member of the Dean’s Advisory Councildean’s advisory council at Boston University School of Management. Mr. Chafetz’s extensive experience in the hospitality, trade show and convention businesses, as well as his experience as a former executive of our predecessor company, led the Board to conclude that he shouldwould be a valuable member of our Board of Directors. Robert G. Goldstein (60)2015IIIMr. Goldstein has been the Company’s President and Chief Operating Officer and a member of the Board of Directors since January 2015. He previously served as the Company’s President of Global Gaming Operations from January 2011 until December 2014 and the Company’s Executive Vice President from July 2009 until December 2014. He has held other senior executive positions at the Company and its subsidiaries since 1995. Mr. Goldstein has served as a member of the Board of Directors of our Company’s subsidiary, Sands China Ltd., since May 2014, and as its interim President from January 2015 through October 2015. From 1992 until joining our Company in December 1995, Mr. Goldstein was the Executive Vice President of Marketing at the Sands Hotel in Atlantic City, as well as an Executive Vice President of the parent Pratt Hotel Corporation. He has served on the Board of Directors of Remark Media, Inc., a global digital media company, since May 2015. Mr. Goldstein’s extensive experience in the hospitality and gaming industries, including as a senior executive officer of our Company (or its predecessors) since 1995, as well as his current position as our President and Chief Operating Officer, led the Board to conclude that he should be a member of our Board of Directors.Charles A. Koppelman (76)2011IIIMr. Koppelman has been a director of the Company since October 2011. Mr. Koppelman currently serves as Chairman and Chief Executive Officer of CAK Entertainment, Inc., an entertainment consultant and brand development firm founded in 1997. From 2005 to 2011, Mr. Koppelman served as Executive Chairman and Principal Executive Officer of Martha Stewart Living Omnimedia, Inc. and served as a director of the company from 2004 to 2011. From 1990 to 1994, he served first as Chairman and Chief Executive Officer of EMI Music Publishing and then from 1994 to 1997 as Chairman and Chief Executive Officer of EMI Records Group, North America. He has served as a director of Six Flags Entertainment Corp. since May 2010, where he serves on the audit committee and the compensation committee. Mr. Koppelman is also a former director of Steve Madden Ltd., and served as Chairman of the Board of that company from 2000 to 2004. Mr. Koppelman’s extensive executive experience, including in the entertainment industry, and his experience as a director of other public companies led the Board to conclude that he should be a member of our Board of Directors.The other members of the Board who will continue to serve following our 2016 annual meeting are as follows:Name (Age), Principal Occupation and Other DirectorshipsFirstBecame aDirectorClassJason N. Ader (48)2009 II Jason N. Ader has been a director of the Company since April 2009. Mr. Ader serves as the chief executive officer of SpringOwl Asset Management LLC, an SEC-registered investment management firm that he founded in October 2013. Mr. Ader also serves as the chief executive officer of Ader Investment Management LLC, a single family office that he founded in 2003. Mr. Ader is also Executive Chairman of MD Insider, Inc., which position he was appointed to in February 2015. Mr. Ader was the founder and chairman of the entity that controls Adelie Food Holdings Ltd., a food products business based in the United Kingdom, which business was sold in March 2015. Mr. Ader also founded Western Liberty Bancorp and served as its chairman and chief executive officer from July 2007 to October 2010 and as a director from June 2007 to October 2012. From 1995 to 2003, Mr. Ader was a Senior Managing Director at Bear, Stearns & Co., Inc. From 1993 to 1995, Mr. Ader served as a Senior Analyst at Smith Barney covering the gaming industry. From 1990 to 1993, Mr. Ader served as a buy-side analyst at Baron Capital, where he covered the hospitality and gaming industries. Mr. Ader is a member of the Advisory Board of New York University’s Center for Hospitality, Travel and Tourism. Mr. Ader’s extensive investment banking and merchant banking experience and his in-depth knowledge about the hospitality and casino industries led the Board to conclude that he should be a member of our Board of Directors.Micheline Chau (63)2014directorDirector of the Company since October 2014. She served as the president, chief operating officer and executive director of Lucasfilm Ltd., a film and entertainment company, from 2003 to 2012 and as its chief financial officer from 1991 to 2003. Before that, Ms. Chau held other executive-level positions in various industries, including retail, restaurant, venture capital and financial services. She currently also serves on the board of directors of Dolby Laboratories, Inc., an audio, imaging and communications company, since February 2013 and was a member of the board of directors of Red Hat, Inc., a provider of open-source software solutions, from November 2008 to August 2012. Ms. Chau also serves on the boards of directors of several private and nonprofit entities, including as Chair of the California HealthCare Foundation. Ms. Chau’s extensive and varied business experience, including as an executive at Lucasfilm Ltd., and her experience as a director of other public companies led the Board to conclude that she shouldwould be a valuable member of our Board of Directors. Patrick Dumont (42) 2017 II Charles D. Forman (69)2004IFormanDumont has been a directorDirector of the Company since April 2017. Mr. Dumont has been the Company’s Executive Vice President and Chief Financial Officer since March 2016 and was our Senior Vice President, Finance and Strategy from September 2013 through March 2016. In addition, Mr. Dumont has served as the Company’s Principal Financial Officer since February 23, 2016. From June 2010 until August 2004.2013, Mr.��Dumont served as the Company’s Vice President, Corporate Strategy. Mr. Dumont is the son-in-law of Sheldon G. Adelson, the Company’s Chairman of the Board, Chief Executive Officer and Treasurer. Mr. Dumont’s experience in corporate finance and his positions and tenure with the Company led the Board to conclude that he would be a valuable member of our Board of Directors.Robert G. Goldstein (61) 2015 III Mr. Goldstein has been the Company’s President and Chief Operating Officer and a member of the Board of Directors since January 2015. He previously served as the Company’s President of Global Gaming Operations from January 2011 until December 2014, the Company’s Executive Vice President from July 2009 until December 2014, and the Company's Secretary from August 2016 to November 2016. He has been a director of Las Vegas Sands, LLC (orheld other senior executive positions at the Company and its predecessor, Las Vegas Sands, Inc.)subsidiaries since March 2004. In addition, he1995. Mr. Goldstein has served as a member of the Boardboard of Directorsdirectors of theour Company’s subsidiary, Sands China Ltd., since May 2014.2014, and as its interim president from January 2015 through October 2015. From 1992 until joining the Company in December 1995, Mr. Forman servedGoldstein was the executive vice president of marketing at the Sands Hotel in Atlantic City, as Chairman and Chief Executive Officer of Centric Events Group, LLC, a trade show and conference business from April 2002 until his retirement upon the salewell as an executive vice president of the business in 2007. From 2000 to 2002, heparent Pratt Hotel Corporation. He has served as a directoron the board of a private company and participated in various private equity investments. During 2000, he was Executive Vice Presidentdirectors of International Operations of Key3Media, Inc. From 1998 to 2000, he was Chief Legal Officer of ZD EventsRemark Media, Inc., a tradeshow business that included COMDEX. From 1995 to 1998,global digital media company, since May 2015. Mr. Forman was Executive Vice President, Chief Financial and Legal Officer of Softbank Comdex Inc. From 1989 to 1995, Mr. Forman was Vice President and General Counsel of The Interface Group, a tradeshow and convention business that owned and operated COMDEX. Mr. Forman was in private law practice from 1972 to 1988. Mr. Forman is a member of the Board of Trustees of The Dana-Farber Cancer Institute. Mr. Forman’sGoldstein’s extensive experience in the hospitality trade show and convention businessesgaming industries, including as a senior executive officer of our Company (or its predecessors) since 1995, as well as his current position as our President and Chief Operating Officer, led the Board to conclude that he shouldwould be a valuable member of our Board of Directors. 8 FirstBecame aDirector Class Steven L. Gerard (70)2011 2014IIIIGerardKoppelman has been a directorDirector of the Company since July 2014. He has servedOctober 2011. Mr. Koppelman currently serves as the chairman of the board of directors of CBIZ, Inc. a provider of integrated business services and products, since October 2002 and was its chief executive officer from October 2000 until March 2016. Mr. Gerard was chairman and chief executive officer of Great Point Capital,CAK Entertainment, Inc., an entertainment consultant and brand development firm founded in 1997. From 2005 to 2011, Mr. Koppelman served as executive chairman and principal executive officer of Martha Stewart Living Omnimedia, Inc. and served as a providerdirector of operational and advisory servicesthe company from 19972004 to October 2000.2011. From 19911990 to 1997,1994, he wasserved first as chairman and chief executive officer of Triangle Wire & Cable, Inc.EMI Music Publishing and its successor Ocean View Capital, Inc. Mr. Gerard’s prior experience includes 16 years with Citibank, N.A. in various senior corporate financethen from 1994 to 1997 as chairman and banking positions. Further, Mr. Gerard served seven years with the American Stock Exchange, where he lastchief executive officer of EMI Records Group, North America. He has served as Vice Presidenta director of the Securities Division. Mr. Gerard alsoSix Flags Entertainment Corp. since May 2010, where he serves on the Boardsaudit committee and the compensation committee. Mr. Koppelman is also a former director of DirectorsSteve Madden Ltd., and served as chairman of Lennar Corporation, a home builder, and Joy Global, Inc., a manufacturer and servicerthe board of mining equipment.that company from 2000 to 2004. Mr. Gerard’sKoppelman’s extensive executive experience, including in the entertainment industry, and servicehis experience as a director of other public companies led the Board to conclude that he shouldwould be a valuable member of our Board of Directors. George Jamieson (79)2014IMr. Jamieson has been a director of the Company since June 2014. He is a certified public accountant and a retired partner of PricewaterhouseCoopers LLP. He served in various positions at PricewaterhouseCoopers LLP (or predecessor firms) in various capacities from 1964 until 1997. Mr. Jamieson is a member of the American Institute of Certified Public Accountants. He recently retired as a member of the executive committee of the board of directors of the American Liver Foundation and has served on the boards of directors of many other charitable and civic organizations. Mr. Jamieson’s extensive experience in the accounting profession, including his experience auditing public companies and his international experience, as well as his service on the boards of directors of charitable and civic organizations led the Board to conclude that he should be a member of our Board of Directors.(64)(65) 2015 II directorDirector of the Company since January 2015. He has served as the Deandean and Professorprofessor of Lawlaw at Duke University School of Law School since July 2007. He served as the Chiefchief United States District Judgedistrict judge for the Eastern District of California from May 2003 until June 2007. He took the oath of office as a United States District Judgedistrict judge in November 1990. He also served as the Presidentiallypresidentially appointed United States Attorneyattorney for the Eastern District of California from 1986 until November 1990. He was a member of the Attorney General’s Advisory Committeeadvisory committee of U.S. Attorneysattorneys and served as chair of the public corruption sub-committee. Prior to his appointment as United States Attorney,attorney, he served as an assistant United States Attorneyattorney for the Eastern District of California. In 2004, he was elected to the Council of the American Law Institute and is currently the president-elect of that organization. He is an elected fellow of the American Academy of Arts and Sciences. He will serve as the chairSciences and a member of the Standing Committee on the American Judicial Systemboard of the American Bar Association until August 2016.National Parks Conservation Association. He served as chair of two judicial conference committees by appointment of the Chief Justice.chief justice. He was named Chairchair of the Civil Rules Advisory Committeecivil rules advisory committee in 2000 and Chairchair of the Standing Committeestanding committee on the Rules of Practice and Procedure in 2003, where he served in that capacity until 2007. Mr. Levi’s extensive legal, judicial, academic and administrative experience, including as a Federal judge and the dean of a major law school, led the Board to conclude that he shouldwould be a valuable member of our Board of Directors. Family RelationshipsMr. Adelson is the father-in-law of Patrick Dumont, the Company’s Executive Vice President and Chief Financial Officer. There is no other family relationship between any of the directors or executive officers of the Company.9INFORMATION REGARDING THE BOARD OF DIRECTORS AND BOARD AND OTHER COMMITTEESBoardBoardAlthough the Company qualifies as a “controlled company” because Mr. Adelson, his wife and trusts and other entities for the benefit of the Adelsons and their family members control more than 50 percent of the voting power of the Company’s Common Stock, the Board has determined that it will not take advantage of the exemptions provided under the NYSE governance rules for “controlled companies.”Independent Directors.The Board has determined that six of the teneleven current members of the Board, namely Mr. Ader, Ms. Chau, Mr. Gerard, Mr. Jamieson, Mr. Koppelman, Mr. Kramer and Mr. Levi, satisfy the criteria for independence under applicable rules promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”“Exchange Act”), and the NYSE corporate governance rules. In addition, Jason N. Ader, who resigned from the Board April 6, 2017, also satisfied the criteria for independence. In making its determinations, the Board reviewed all the relevant facts and circumstances, the standards set forth in our Corporate Governance Guidelines, the NYSE rules and other applicable laws and regulations.Two of our outside directors, Messrs. Chafetz and Forman, have business and personal relationships with our controlling stockholder, Mr. Adelson. Mr. Chafetz was a stockholder, vice president and director of the entity that owned and operated the COMDEX trade show and The Sands Expo and Convention Center, which were created and developed by Mr. Adelson. Mr. Forman was vice president and general counsel of this entity. Mr. Chafetz also is a trustee of several trusts for the benefit of Mr. Adelson’s family members that beneficially own shares of our Common Stock. For additional information, see “Proxy and Voting Information — How You Can Vote” and “Principal Stockholders” above. These relationships with Mr. Adelson also include making joint investments and other significant financial dealings. As a result, Messrs. Adelson, Chafetz and Forman may have their financial interests aligned and, therefore, the Board does not consider Messrs. Chafetz and Forman to be independent directors.Board Meetings.The Board held ninesix meetings and acted by written consent sixseven times during 2015.2016. The work of the Company’s directors is performed not only at meetings of the Board and its committees, but also by consideration of the Company’s business through the review of documents and in numerous communications among Board members and others. In 2015,2016, all directors attended at least 75% of the aggregate of all meetings of the Board and committees on which they served during the periods in which they served, except for Michael A. Leven who retired from the Board in April 2016.served.Annual Meeting.Our directors are encouraged to attend each annual meeting of stockholders and all of our directors attended our 20152016 annual meeting of stockholders held on June 4, 2015.3, 2016.Board CommitteesStanding and Other Committees.Our Board has four standing committees: an audit committee (the “Audit Committee”“Audit Committee”), a compensation committee (the “Compensation Committee”“Compensation Committee”), a nominating and governance committee (the “Nominating“Nominating and Governance Committee”Committee”) and a compliance committee (the “Compliance Committee”“Compliance Committee”). In addition, the Board established a COO Search Committee in December 2012, which was dissolved in January 2015.Audit Committee.The Audit Committee operates under a written charter. The primary purpose of the Audit Committee is to assist the Board in monitoring the integrity of our financial statements, our independent registered public accounting firm’s qualifications and independence, the performance of our audit function, and the compliance of our independent registered public accounting firm and our Company with legal and regulatory requirements. Among other things, our Audit Committee selects our independent registered public accounting firm and reviews with such firm the plan, scope and results of our annual audit, and the fees for the services per-formed.performed. The Audit Committee also reviews the adequacy of our internal control systems with management and the independent registered public accounting firm and receives internal audit reports, and subsequently reports its findings to the full Board. In addition, the Audit Committee is charged with reviewing related party transactions as further described below under “Corporate Governance — Related Party Transactions” and with overseeing the Company’s enterprise risk management as further described10below under “Corporate Governance — The Board’s Role in Risk Oversight” and its cyber security program. The Audit Committee also oversees the Company’s responses to designated stockholder derivative actions.The current members of our Audit Committee are George Jamieson (Chair), Jason N. Ader and Steven L. Gerard.Gerard and Lewis Kramer. Mr. Ader was a member of our Audit Committee until his resignation on April 6, 2017. The Board has determined that Messrs. Jamieson, AderGerard and GerardKramer are each independent under applicable NYSE and federal securities rules and regulations on independence of Audit Committee members. The Board has determined that each of the members of the Audit Committee is “financially literate” and that Mr. Jamieson qualifies as an “audit committee financial expert,” as defined in the NYSE’s listing standards and federal securities rules and regulations. The Audit Committee held 1210 meetings and did not act by written consent during 2015.2016. The Audit Committee’s activities also are undertaken by numerous discussions and other communications among its members and others.Compensation Committee.The Compensation Committee operates under a written charter pursuant to which it has direct responsibility for the compensation of our executive officers. The Compensation Committee has the authority to set salaries, bonuses and other elements of employment and to approve employment agreements for our executive officers and certain other highly compensated employees. The Compensation Committee also may delegate its authority to the extent permitted by the Board, the Compensation Committee charter, our by-laws, state law and NYSE regulations. In addition, the Compensation Committee has the authority to approve employee benefit plans as well as to administer our 2004 Equity Award Plan.Plan (Amended and Restated) (the "2004 Equity Award Plan"), our equity award plan under which we grant stock options and other equity awards. The Compensation Committee also is involved in the Company’s enterprise risk management process as further described below under “Corporate Governance — The Board’s Role in Risk Oversight” and “Corporate Governance — 20152016 Executive Compensation Risk Assessment.”The current members of the Compensation Committee are Steven L. Gerard (Chair), Micheline Chau and Charles A. Koppelman. The Compensation Committee held sixfive meetings and acted by written consent threefive times during 2015.2016. Additional information about the Compensation Committee, its responsibilities and its activities is provided below under “Compensation Discussion and Analysis.”Nominating and Governance Committee.The Nominating and Governance Committee operates under a written charter and has the authority to, among other things, review and make recommendations regarding the composition of the Board and its committees; develop and implement policies and procedures for the selection of Board members; identify individuals qualified to become Board members; and select, or recommend that the Board select, director nominees. The Nominating and Governance Committee also is responsible for assessing, developing and making recommendations to the Board with respect to Board effectiveness and related corporate governance matters, including corporate governance guidelines and procedures intended to organize the Board appropriately;appropriately, and overseeing the evaluation of the Board and management. The current members of the Nominating and Governance Committee are David F. Levi (member and Chair as of January 29, 2015)(Chair), Jason N. Ader and Charles A. Koppelman. TheKoppelman and Lewis Kramer. Mr. Ader was a member of our Nominating and Governance Committee until his resignation on April 6, 2017.The Nominating and Governance Committee held sixfour meetings and did not act by written consent during 2015.2016.Compliance Committee.The Compliance Committee operates under a written charter and assists the Board in overseeing our Company’s compliance program with respect to: (a) compliance with the laws and regulations applicable to the Company’s business, including gaming laws; and (b) compliance withwith: the Company’sCompany's (i) Code of Business Conduct and Ethics, its(ii) Anti-Corruption Policy Including Guidelines on Travel and Entertainment Expenses and Customer Complimentaries for Government Officials, its(iii) Statement on Reporting Ethical Violations, its(iv) anti-money laundering policies, and (v) related policies and procedures applicable to the Company’s team members, officers, directors and other agents. The current members of the Compliance Committee are Charles A. Koppelman (Chair), Micheline Chau, Steven L. Gerard and David F. Levi (as of January 29, 2015).Levi. The Compliance Committee held sixfour meetings and did not act by written consent during 2015.2016.Compensation Committee Interlocks and Insider Participation.The members of the Compensation Committee during 20152016 were Micheline Chau, Steven L. Gerard and Charles A. Koppelman. None of the20152016 is, or has been, an employee or officer of the Company. None of our executive officers serves,serve, or in the past year served, as a member of the Boardboard of directors or Compensation Committeecompensation committee of any entity that has one or more executive officers who serve on our Board or Compensation Committee.11Other Non-Board CommitteeOperational Compliance Committee. The Company has an operational compliance committee (the “Operational Compliance Committee”) that operates under a written regulatory Compliance Program approved by the Nevada Gaming Control Board. The Company created the Operational Compliance Committee to exercise its best efforts to identify and evaluate situations arising in the course of the Company’s businesses, wherever conducted, which may have an adverse effect upon its objectives or those of gaming control and thereby cause concern to any gaming authority. The Operational Compliance Committee monitors the Company’s activities so as to assist the Company’s senior management with regard to the Company’s (a) business associations, that is, to protect the Company from associations with persons denied licensing or other related approvals, or who may be deemed unsuitable to be associated with the Company; (b) business practices and procedures; (c) compliance with any special conditions imposed upon the Company’s license(s); (d) reports submitted to gaming authorities; and (e) compliance with the laws, regulations and orders of governmental agencies having jurisdiction over the Company’s gaming or business activities. The Company’s Senior Vice President and Global Chief Compliance Officer is the Chair of the Operational Compliance Committee and provides quarterly updates to the Compliance Committee. The Operational Compliance Committee also has an independent member who is not otherwise employed by the Company and who possesses a background in and extensive experience with gaming control in Nevada. The remaining members of the Operational Compliance Committee are employees of the Company.12CORPORATE GOVERNANCECommitment to Corporate Governance.Our Board and management have a strong commitment to effective corporate governance. We have in place a comprehensive corporate governance framework for our operations which, among other things, takes into account the requirements of the Sarbanes-Oxley Act of 2002, the Dodd-Frank Wall Street Reform and Consumer Protection Act and the applicable rules and regulations of the Securities and Exchange CommissionSEC and the NYSE. The key components of this framework are set forth in our amended and restated articles of incorporation and by-laws, along with the following additional documents:Copies of each of these documents are available on our website athttp://investor.sands.com by clicking on “Investor Relations,” and then on the section entitled “Governance.” Copies also are available without charge by sending a written request to Investor Relations at the following address: Investor Relations, Las Vegas Sands Corp., 3355 Las Vegas Boulevard South, Las Vegas, Nevada 89109.Corporate Governance Guidelines.We have adopted Corporate Governance Guidelines for our Company that set forth the general principles governing the conduct of the Company’s business and the role, functions, duties and responsibilities of the Board, including, but not limited to, such matters as composition, membership criteria, orientation and continuing education, retirement, committees, compensation, meeting procedures, annual evaluation and management succession planning.Code of Business Conduct and Ethics.We have adopted a Code of Business Conduct and Ethics that applies to all of the Company’s directors, officers (including the principal executive officer, principal financial officer and principal accounting officer), employees and agents. The Code of Business Conduct and Ethics establishes policies and procedures that the Board believes promote the highest standards of integrity, compliance with the law and personal accountability. The Company’s Code of Business Conduct and Ethics is provided to all new directors, officers and employees.Anti-Corruption Policy. We have adopted an Anti-Corruption Policy to assureensure that the hospitality and business development practices of all of our operations anywhere in the world are fully consistent with applicable record keeping and anti-corruption laws, including the U.S. Foreign Corrupt Practices Act and the Sarbanes-Oxley Act of 2002. The Anti-Corruption Policy is provided to all new directors, officers and employees.Statement on Reporting Ethical Violations.We have adopted a Statement on Reporting Ethical Violations to facilitate and encourage the reporting of any misconduct at the Company, including violations or potential violations of our Code of Business Conduct and Ethics, and to ensure that those reporting such misconduct will not be subject to harassment, intimidation or other retaliatory action. The Statement on Reporting Ethical Violations is provided to all new directors, officers and employees.Related Party Transactions.We have established policies and procedures for the review, approval and/or ratification of related party transactions. Under its charter, the Audit Committee approves all related party transactions required to be disclosed in our public filings and all transactions involving executive officers or directors of the Company that are required to be approved by the Audit Committee under the Company’s Code of Business Conduct and Ethics. Our conflict of interest policy sets forth additional procedures governing related party transactions. Under our procedures, our executive officers and directors provide our corporate counsel’s office with13approval. The Audit Committee may, in its discretion, request additional information from the director or executive officer involved in a proposed transaction or from management prior to granting approval for a related party transaction. All other related party transactions by individuals subject to our Code of Business Conduct and Ethics and conflict of interest policy must be approved by our Global Chief Compliance Officer and reported to the Compliance Committee and the Audit Committee.Nomination of Directors.The Nominating and Governance Committee proposed to the Board the candidates nominated for election at this annual meeting. The Nominating and Governance Committee, in making its selection of director candidates, considered the appropriate skills and personal characteristics required in light of the then-current makeup of the Board and in the context of the perceived needs of the Company at the time.The Nominating and Governance Committee considers a number of factors in selecting director candidates, including:The Nominating and Governance Committee has the discretion to weightweigh these factors as it deems appropriate. The importance of these factors may vary from candidate to candidate.The Nominating and Governance Committee will consider candidates recommended by directors and members of management and may, in its discretion, engage one or more search firms to assist in the recruitment of director candidates. The Nominating and Governance Committee does not have a policy for considering director candidates recommended by security holders and believes that not having such a policy is appropriate in light of the significant ownership of the Company’s Common Stock by Mr. Adelson and his family.Board Leadership Structure.Mr. Adelson serves as the Chairman of the Board and Chief Executive Officer of our Company. Mr. Adelson is the founder of our Company and has served as its Chairman and Chief Executive Officer since the Company was founded. The Board believes that Mr. Adelson is best suited to serve as both its Chairman and14Chief Executive Officer because he is the most familiar with the Company’s businesses and industry and best able to establish strategic priorities for the Company. In addition, Mr. Adelson, his wife and trusts and other entities for the benefit of the Adelsons and their family members together beneficially owned approximately 54.3%54.5% of our outstanding Common Stock as of the record date. Accordingly, Mr. Adelson exercises significant influence over our business policies and affairs, including the composition of our Board of Directors. As a result, the Board believes that Mr. Adelson’s continuing service as both Chairman and Chief Executive Officer is beneficial to the Company and provides an effective leadership structure. The Company does not have a lead director.The Board’s Role in Risk Oversight.The Board of Directors, directly and through its committees, is actively involved in the oversight of the Company’s risk management policies. The Audit Committee is charged with overseeing enterprise risk management, generally, and with reviewing and discussing with management the Company’s major financial risk exposures and the steps management has taken to monitor, control and manage these exposures, including the Company’s risk assessment and risk management guidelines and policies. The Compensation Committee oversees the Company’s compensation policies generally to determine whether they create risks that are reasonably likely to have a material adverse effect on the Company. The Compliance Committee assists the Board in overseeing the Company’s compliance program, including compliance with the laws and regulations applicable to the Company’s business and compliance with the Company’s Code of Business Conduct and Ethics and other policies. The Audit Committee, the Compensation Committee and the Compliance Committee receive reports from, and discuss these matters with, management and regularly report on these matters to the Board.20152016 Executive Compensation Risk Assessment.The Compensation Committee has evaluated the Company’s compensation structure from the perspective of enterprise risk management and the terms of the Company’s compensation policies generally and does not believe that the Company’s compensation policies and practices provide incentives for employees to take inappropriate business risks or risks that are reasonably likely to have a material adverse effect on the Company. As described under “Compensation Discussion and Analysis” below regarding bonuses for our named executive officers, Mr. Adelson is eligible to receive bonuses under his employment agreement, subject to the Company’s achievingachievement of predetermined EBITDA-based performance goals. Under their employment agreements, or other employment arrangements, the other named executive officers are eligible for discretionary bonuses, up to a target percentage of their respective base salaries. Similarly, any bonuses for employees other than the named executive officers are granted on a discretionary basis. In making its determinations regarding 20152016 bonuses for Mr. Goldstein and Mr. Raphaelson,Dumont, the Compensation Committee’s decision was based on the Company’s achievement of pre-determinedpredetermined EBITDA-based performance targets. In making its determinations regarding the 20152016 bonus for Mr. Markantonis,Tanasijevich, the Compensation Committee’s decision was based on the achievement of pre-determinedpredetermined EBITDA-based performance targets by the Company’s Las Vegas properties. Pursuant to Mr. Quartieri’s Separation Agreement (as defined below), he was entitled to a pro-rated bonus for 2015, payable if, when and to the extent such bonuses were paid to like situated executives.Marina Bay Sands. In making its determinationdeterminations regarding the 2016 bonus for Mr. Quartieri’s 2015Jacobs, the annual bonus was determined by the Compensation Committee gave equal weighting to (a)performance criteria established by the Company’s achievement of the Company’s pre-determined EBITDA-based performance targets and (b) his individual performance.Chief Executive Officer. The Compensation Committee believes that the Company’s compensation policies do not incentivize our named executive officers or other employees to take inappropriate business risks or risks that are reasonably likely to have a material adverse effect on the Company because the discretionary nature of the bonuses and the weightingweighing of financial and individual performance factors means there may not be any direct correlation between any particular action by an employee and the employee’s receipt of a bonus.Presiding Non-Management Director.In accordance with applicable rules of the NYSE and the Company’s Corporate Governance Guidelines, the Board has adopted a policy to meet at least quarterly in executive session without management directors or any members of the Company’s management being present. In addition, the Board’s independent directors meet at least once each year in executive session. At each executive session, a presiding director chosen by a majority of the directors present will preside over the session.Stockholder Communications with the Board and Audit Committee. The Board has established a process for stockholders and interested parties to communicate with members of the Board, the Audit Committee, the non-management directors and the presiding non-management director of executive sessions of the Board.Director CommunicationsBoard of Directors of Las Vegas Sands Corp.c/o Corporate Secretary3355 Las Vegas Boulevard SouthLas Vegas, Nevada 89109Complaints and concerns relating to our accounting, internal accounting controls or auditing matters should be communicated to the Audit Committee of our Board using the procedures described below. All other stockholder and other communications addressed to our Board will be referred to our presiding non-management director of executive15sessions and tracked by the Corporate Secretary. Stockholder and other communications addressed to a particular director will be referred to that director.Stockholder Communications with the Audit Committee CommunicationsCommittee. Las Vegas Sands Corp.3355 Las Vegas Boulevard SouthLas Vegas, Nevada 89109Attention: Office of the General CounselAll communications will be reviewed under Audit Committee direction and oversight by the Office of the General Counsel, the Audit Services Group, which performs the Company’s internal audit function, or such other persons as the Audit Committee determines to be appropriate. Confidentiality will be maintained to the fullest extent possible, consistent with the need to conduct an adequate review. Prompt and appropriate corrective action will be taken when and as warranted in the judgment of the Audit Committee. The Office of the General Counsel will prepare a periodic summary report of all such communications for the Audit Committee.16EXECUTIVE OFFICERSThis section contains certain information about our current executive officers, including their names and ages (as of the mailing of these proxy materials), positions held and periods during which they have held such positions. There are no arrangements or understandings between our officers and any other person pursuant to which they were selected as officers. Age 8283 6061 4142 George M. Markantonis 5861 President and Chief Operating Officer, The Venetian/The Palazzo and Sands Expo & Convention CenterIra H. Raphaelson62George Tanasijevich54Chief Executive Officer and President, Marina Bay Sands Pte Ltd and Managing Director, Global Development, Las Vegas Sands Corp.For background information on Messrs. Adelson, Dumont and Goldstein, please see “Board of Directors.”Patrick DumontLawrence A. Jacobs has been our Company’s Chief Financial Officer since March 2016 and our Company’s Senior Vice President, Finance and Strategy from September 2013 through March 2016. In addition, Mr. Dumont has served as the Company’s principal financial officer since February 23, 2016. From June 2010 until August 2013, Mr. Dumont served as the Company’s Vice President, Corporate Strategy. Mr. Dumont is the son-in-law of Sheldon G. Adelson, the Company’s Chairman of the Board, Chief Executive Officer and Treasurer.George M. Markantonis has been the President and Chief Operating Officer of Venetian Casino Resort, LLC (owner of The Venetian/The Palazzo) and Sands Expo & Convention Center and Senior Vice President of Las Vegas Sands, LLC since March 2015. Mr. Markantonis has more than 35 years of international hospitality industry experience, including serving as the President and Managing Director of Atlantis, Paradise Island from September 2005 to February 2015, as the Chief Executive Officer of Atlantis of The Palm of Dubai, from March 2004 to August 2005, and in various positions at Caesars Palace in Las Vegas from 1995 to 2004, most recently as Senior Vice President of Hotel Operations.Ira H. Raphaelson has been theCompany's Executive Vice President and Global General Counsel of Las Vegas Sands Corp. since November 2011September 2016 and theour Company’s Secretary since January 2015.November 2016. Prior to joining our Company, Mr. RaphaelsonJacobs served as executive vice president and general counsel for Time, Inc. from November 2013 to September 2016, as well as senior executive vice president and group general counsel for News Corporation from January 2005 to June 2011. Additionally, he served as general counsel of Scientific Games Corp.Empire State Development, New York State's chief economic development agency from February 2006 until October 2011April 2013 to November 2013 and as its secretarya consultant at East Wind Advisors from June 2006 until October 2011.2011 to April 2013. Mr. Raphaelson wasJacobs began his legal career at Squadron Ellenoff (subsequently merged into Hogan Lovells). Mr. Jacobs is a partner in the Washington D.C. officeTrustee of the law firm of O’Melveny & Myers LLP for ten yearsNew York Historical Society, Muhlenberg College, Literacy Partners and a partner in the Washington D.C. office of Shaw Pittman for three years. Prior to entering private practice, he was a stateAmerican Corporate Partners, and federal prosecutor for 15 years, serving the last two years as a Presidentially appointed Special Counsel for Financial Institutions Crime.George Tanasijevich has been the President and Chief Executive Officer of our Company’s subsidiary, Marina Bay Sands Pte Ltd since July 2011 and the Managing Director, Global Development of Las Vegas Sands Corp. since January 2011. He also has held other senior executive positions at our Company’s Singapore operations since 2005. Prior to that, Mr. Tanasijevich was the Company’s Director of Development, based in Macao, from 2004 to 2005. Mr. Tanasijevich previously served as Senior Vice President/Equity Markets at CapitaLand Limited, a Singapore-based real estate conglomerate, and as Corporate Vice President of General Growth Properties, a shopping mall REIT. Mr. Tanasijevich is a member of the University of Chicago Booth School of Business Global Advisory Board and the University of Michigan Provost Committee, and a Board Member of the Singapore International Chamber of Commerce, the Singapore Hotel Association and the U.S. — Japan Business Council.Council on Foreign Relations.Section 16(a) Beneficial Ownership Reporting ComplianceSection 16(a) of the Exchange Act requires the Company’s directors and executive officers and the beneficial owners of more than 10% of our Common Stock to file reports of ownership of our Common Stock with the Securities and Exchange Commission.SEC. Directors, executive officers and beneficial owners of more than 10% of our Common Stock are required to furnish the Company with copies of all Section 16(a) forms that they file. Based upon a review of these filings and representations from the Company’s directors, executive officers and 10% beneficial owners that no other reports were required, the Company notes that all reports for the year 20152016 were filed on a timely basis.17The following discussion and analysis contains statements regarding Company performance objectives and targets. These objectives and targets are disclosed in the limited context of our compensation program and should not be understood to be statements of management’s expectations or estimates of results or other guidance. We specifically caution investors not to apply these statements to other contexts.COMPENSATION DISCUSSION AND ANALYSISThis discussion supplements the more detailed information concerning executive compensation in the tables and narrative discussion that follow under “Executive Compensation and Other Information.” This Compensation Discussion and Analysis section discusses our compensation philosophy and objectives and the compensation policies and programs for the following individuals who are referred to as our “named executive officers”: for 2016:Ira H. Raphaelson,Patrick Dumont, our Executive Vice President and Chief Financial Officer;Lawrence A. Jacobs, our Executive Vice President, Global General Counsel and Secretary;M. Markantonis, theTanasijevich, our President and Chief OperatingExecutive Officer, of Venetian Casino Resort, LLCMarina Bay Sands Pte. Ltd. and Sands Expo & Convention Center and Senior Vice President ofManaging Director, Global Development, Las Vegas Sands LLC (since March 2015)Corp.; andMichael Quartieri,Ira H. Raphaelson, our former SeniorExecutive Vice President, Global ControllerGeneral Counsel and Chief Accounting Officer (principal financial officer).20152016 Financial and Business PerformanceHighlights of the Company’s 20152016 financial performance and business achievements include:$11.69$11.41 billion;consolidated adjusted property EBITDA of $4.17 billion;$4.13 billion.income of $2.03 billion, or $2.55 per diluted share; andthe return of $2.28 billion of capital to stockholders through the payment of $2.07 billion of regular annual dividends and the repurchase of $205.0 million of its outstanding common stock.In October 2015, the Company announced a 10.8% increase in the Company’s recurring common stock dividend from $2.60 per share in 2015 to $2.88 per share in 2016.

attract and retain key executive talent by providing the named executive officers with competitive compensation;

reward the named executive officers based upon the achievement of Company, property and individual performance goals; and

align the interests of the named executive officers with those of our stockholders.